"What is a short sale?"

Simply put, a short sale is a real estate transaction where the

homeowner owes their lender more than what their property is worth and

they need to sell. In a short sale, the lender must approve and accept

less than what they are owed as full payoff (this means they may settle

for $400,000, even if you currently owe them $500,000...even if the loss

is hundreds of thousands of dollars).

-

Are you facing a financial hardship that you know

will decrease your income?

-

Are you getting behind on your mortgage and you're

not sure if you can catch up?

-

Or do you just need to sell quickly but your home

is worth less now than when you bought it?

If you are facing any of the situations above, and you

think a short sale might be your best option, then read on. If you're

still not sure and just want more info, then scroll to the bottom of

this page and request a free copy of our article "The 9 Alternatives

When Facing Foreclosure"

Don't worry. It's not your fault...

Remember, we've all had our ups and downs in life and

a lot of other good people are also in the same tough spot as you. Life

seems scary when you're facing the reality of foreclosure and I know how

you feel when you just don't want to answer the phone any more...

We all agree that we're in the middle of a national

mortgage crisis and that, in many cases, homeowners who have bought or

refinanced in the last few years have been seriously abused by unethical

lending practices!!

You bought your home and hoped (like we all did) that

it would increase in value (and some folks were even promised it

would!), but most likely the harsh reality is that now your home is

worth less than when you bought it and the value is still declining

sharply.

It's sad but true!

Did you know that nearly 90% of the homeowners

nationwide who try to "short sale" their home will end up

losing their home to foreclosure

due to an uneducated or lazy agent?

Don't allow this to happen to you!

The majority of real estate agents that are "trying to

help" have not been properly trained and sadly, they are misinformed as

to how to even negotiate with lenders. Some even get so far as to submit

your 'short sale packet' and then just sit back and wait for a response.

In the end, many simply don't know how to help you and you will become

one of those "90%" that were not helped.

"Short sales are not easy!"

...unless you seek the help of an expert agent with a

proven track record. We have partnered with a team that was trained by a

former Chief Loss Mitigator who is a career loss mitigator and asset

manager with 20 years in the business (the official at the bank who

accepts or declines short sales). We are now helping save even more

folks from foreclosure.

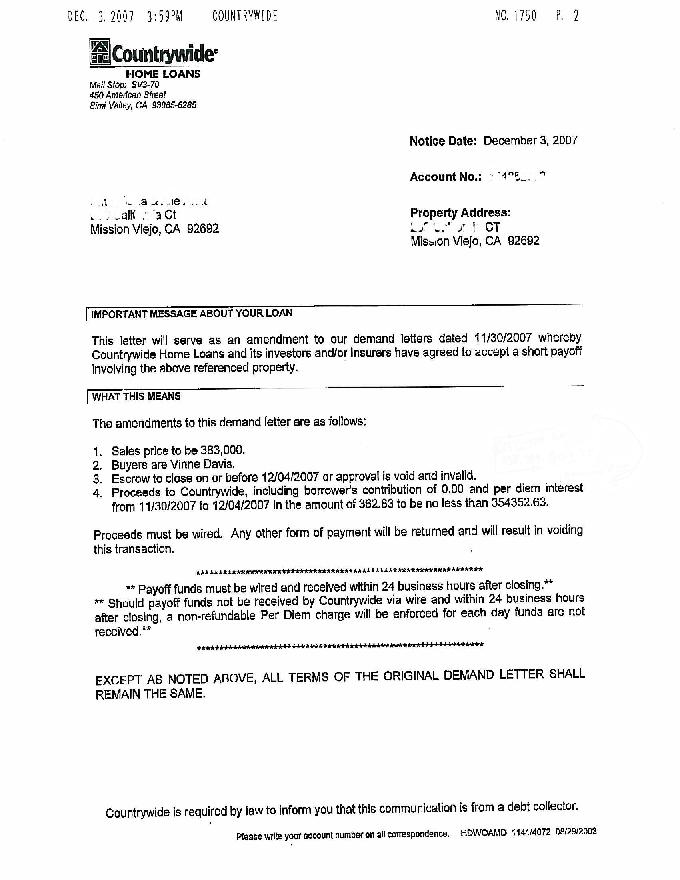

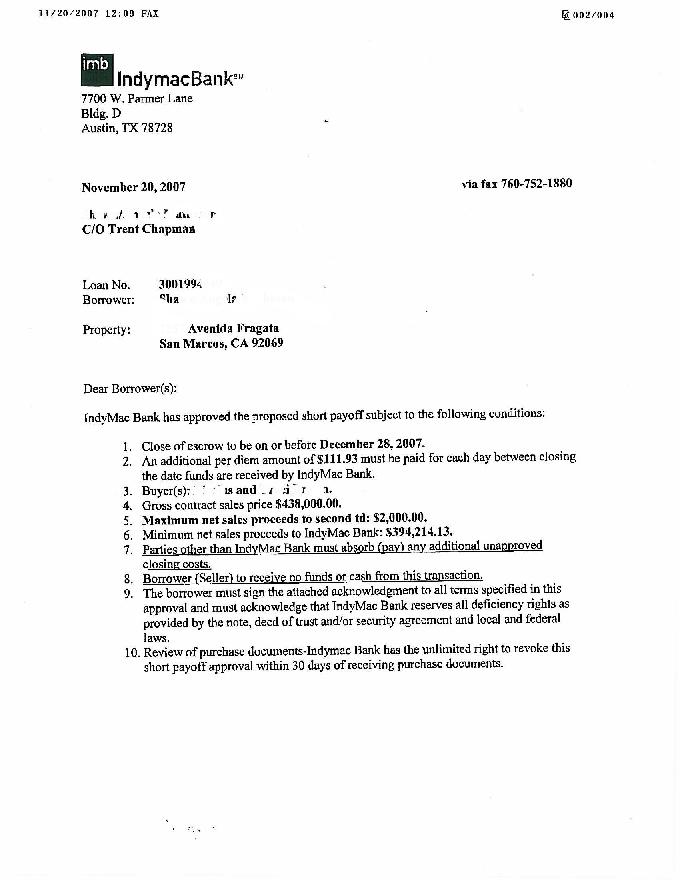

We have successfully negotiated short sales and as you

can see from recent approval letters below, banks actually say YES to

our short sales. Before you agree to have an agent help you sell your

home, ask him/her to show you just one short sale approval.

The best part is, the team we are working with has

taken his tips and tricks from working INSIDE THE BANK

and has a track record of bank acceptance 93.2% of the time!

Management in our partner company most recently worked

for IndyMac Bank, a top ten lender, as the head of

their HELOC loss mitigation division. This insider knowledge and broad

base of industry contacts allows us to get our approvals faster than

many other agents in California!

Now it's up to you...

We are ready, along with our team of experts, to go to battle for

you. Are you ready to take a serious look at your options and see

how a short sale can help you:

- Avoid paying TAXES on the money the bank loses at

foreclosure! (Yes, you may have to pay taxes on the

amount of loss to the bank if the home goes to foreclosure!)

- Save your credit from the "Foreclosure" ding

- Avoid Bankruptcy

- Avoid Foreclosure

- Relieve the stress that this financial burden has become

- WITH NO OUT OF POCKET FEES OR ANY UP FRONT COSTS OF ANY

KIND! ...or in other words, you pay me nothing and if I do my

job and save you from foreclosure, only then will I get paid by

the lender!

Example of a Countrywide Short Sale

Approval

Example of a Indymac Short Sale Approval

Not all agents can do a short sale and not all people qualify for

our help. We are here for you if your situation meets the following

criteria:

- You have a valid hardship

- You have little or no equity in your home

- You are unable (or soon will be unable) to pay your bills on

time

- You want to work with an expert

If you're not sure and just want to find out if you qualify, give us

a call and we will walk you through your options. Believe it or not, you

may just need help getting a temporary reduction in your payments to

'catch up'. In any case, call us to talk about the several options that

you may not be aware of.